how much does illinois tax on paychecks

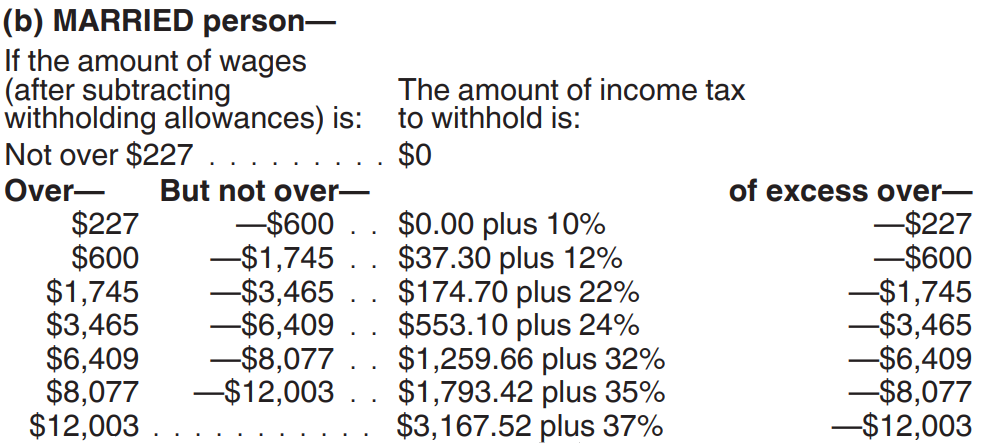

Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124. 915 on portion of taxable income over 44470 up-to 89482.

What Is The Trust Fund Recovery Penalty Gordon Law Group

Therefore fica can range between 153 and 162.

. Starting with the 2018 tax year Form IL-941 Illinois Withholding Income Tax Return. How To Calculate Taxes Taken. What percentage is taken out of paycheck taxes.

This 153 federal tax is made up of two parts. Additional Medicare Tax. The wage base is 12960 for 2022 and rates range from 0725 to 7625.

This is a projection based on information you provide. So the tax year 2022 will start from July 01 2021 to June 30 2022. Rates are based on several factors including your industry and the amount of previous benefits paid.

How much tax is deducted from a paycheck Canada. Payroll taxes in Illinois. If you are unable to file electronically you may request Form IL-900-EW Waiver Request through our.

As of January 1 2022 the Illinois unemployment tax rate ranges from 0725 to 7625. Newly registered businesses must register with IDES within. If an employees hourly rate is 12 and they worked 38 hours in the pay period the employees gross pay for that paycheck is 45600 12 x 38.

The Illinois bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. How Much Taxes Is Taken Out Of A Paycheck In Illinois.

Just enter the wages tax withholdings and other information required. How Much Does Illinois Tax On Paychecks. Personal Income Tax in Illinois.

2022 Federal Tax Withholding Calculator. 505 on the first 44470 of taxable income. There is an Additional Medicare Tax of 09 percent withheld from employees paychecks if they earn more than 200000 annually regardless of.

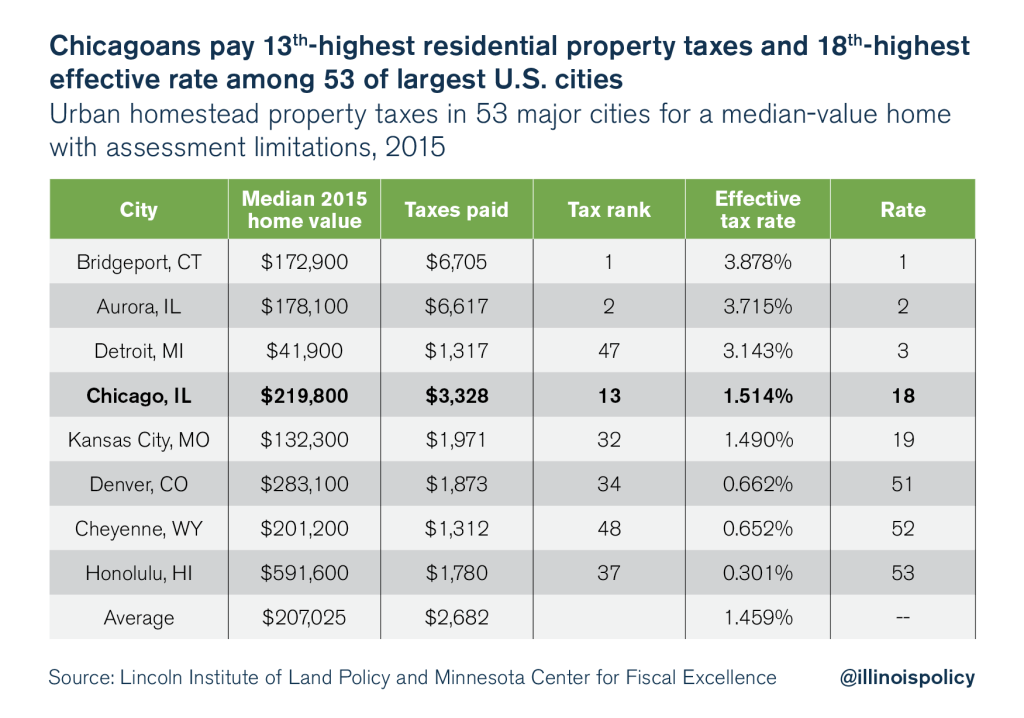

Calculating your Illinois state income tax is similar to the steps we listed on our Federal paycheck calculator. 495Everyones income in Illinois is taxes at the same rate due to the states flat income tax system of 495. There are two state taxes to be aware of in Illinois.

How Much Does Illinois Tax On Paychecks. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck. Personal income tax in Illinois is a flat.

Personal income tax and unemployment tax. Therefore fica can range between 153 and 162. How To Calculate Taxes Taken.

This calculator is a tool to estimate how much federal income tax will be withheld. If youre a new employer your rate is 353. How much does wisconsin take.

This 153 federal tax is made up of two parts.

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

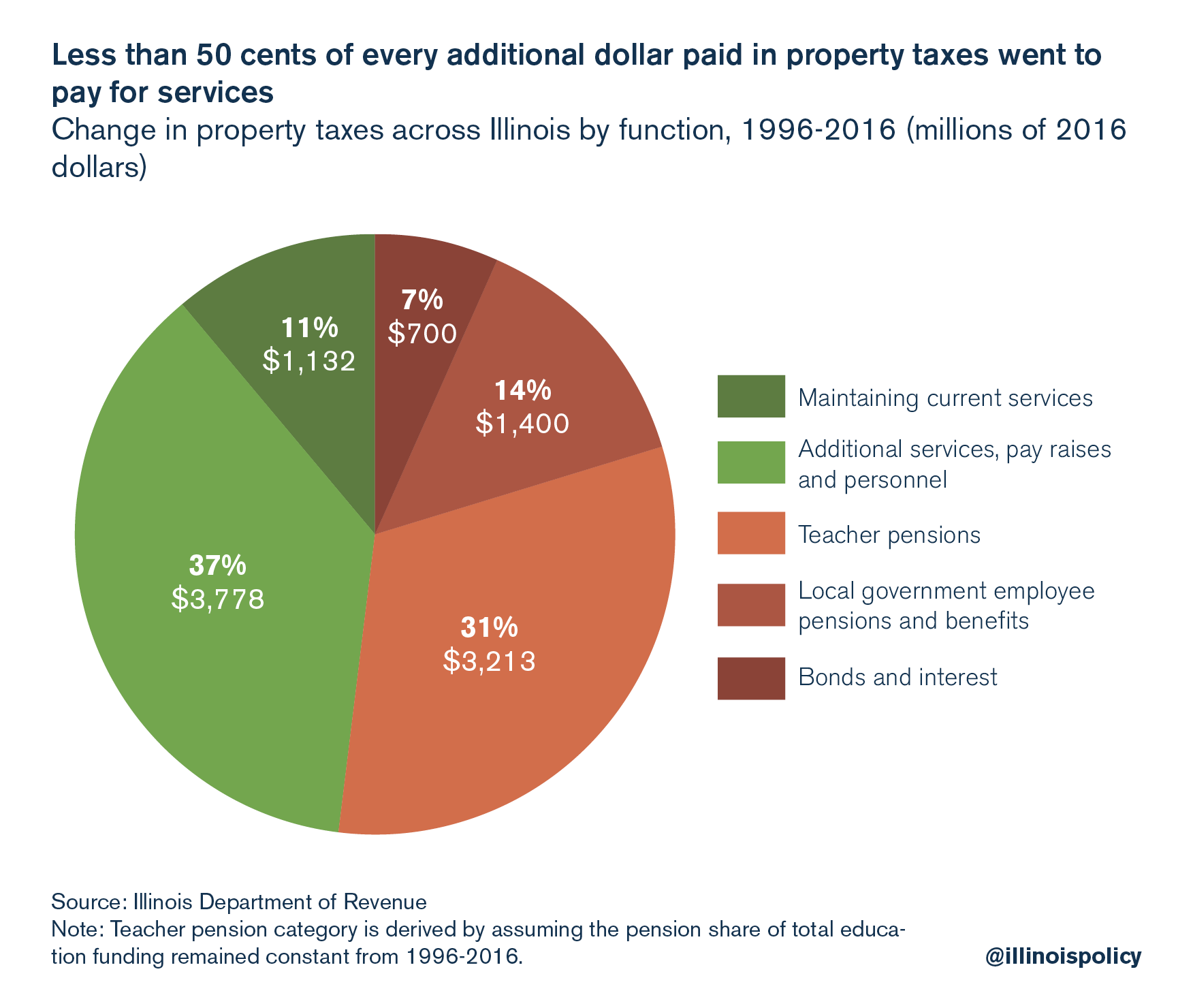

Study Illinois Property Taxes Still Second Highest In Nation

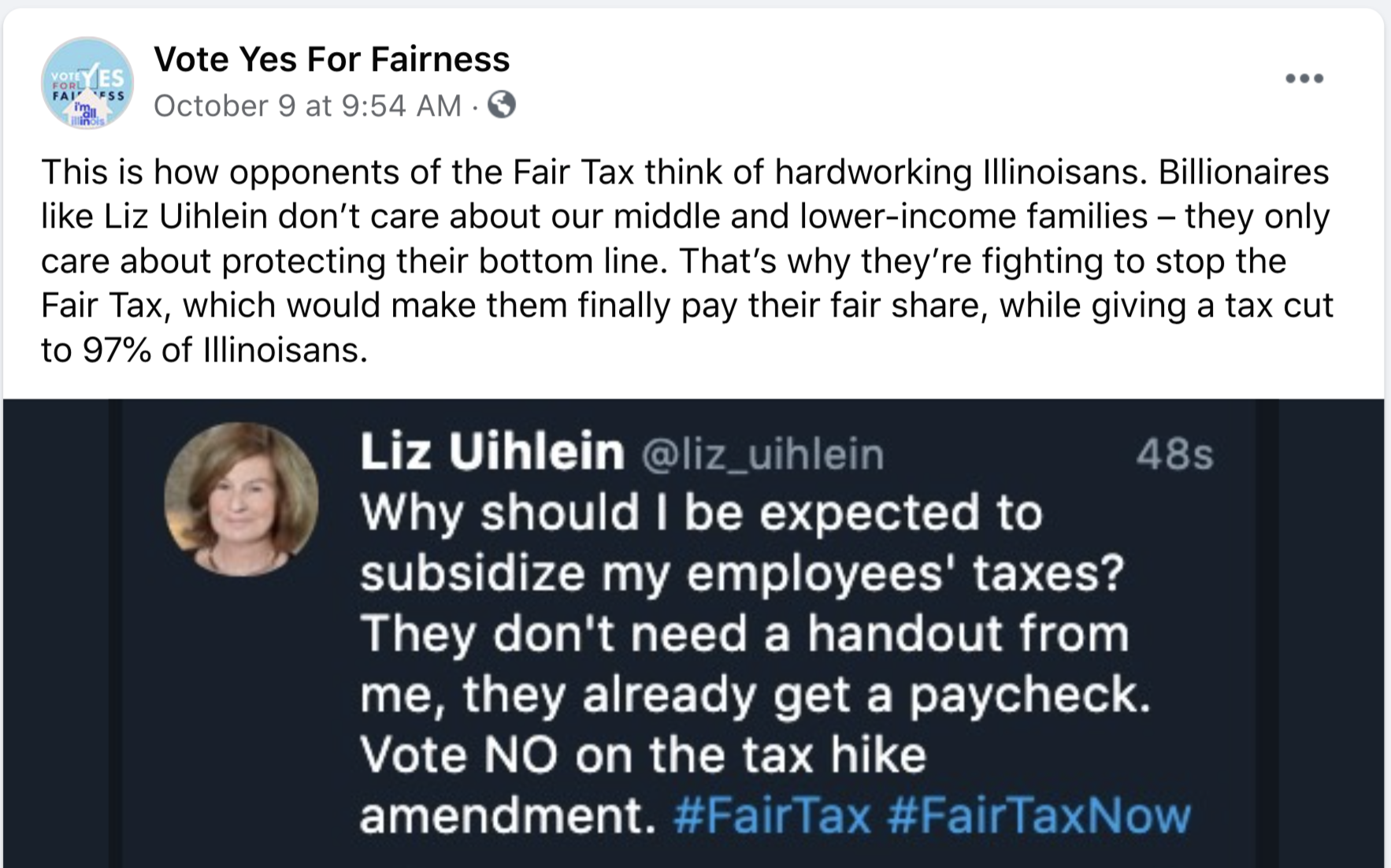

Pritzker Fair Tax Group Pays Over 10 000 To Push Fake Tweet

What Taxes Are Taken Out Of A Paycheck In Illinois

Can You Opt Out Of Paying Social Security Taxes Mybanktracker

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog

Trump Payroll Tax Holiday How It Affects Paychecks In 2021 Money

Why Illinois Is In Trouble 109 881 Public Employees With 100 000 Paychecks Cost Taxpayers 14b

/cloudfront-us-east-1.images.arcpublishing.com/gray/JNMTSFRMONIZTGZVTHQULDKVWU.jpg)

Illinois Workers Brace For Paycheck Reductions

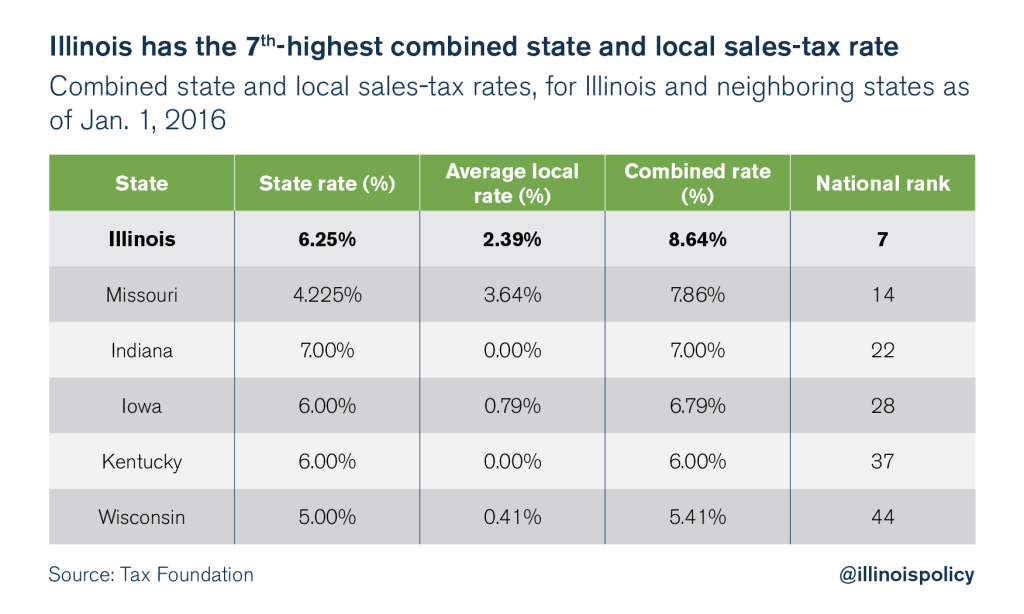

Illinois Is A High Tax State Illinois Policy

What Are Employer Taxes And Employee Taxes Gusto

How Many Tax Allowances Should I Claim Community Tax

9 States With No Income Tax Kiplinger

Free Hourly Payroll Calculator Hourly Paycheck Payroll Calculator

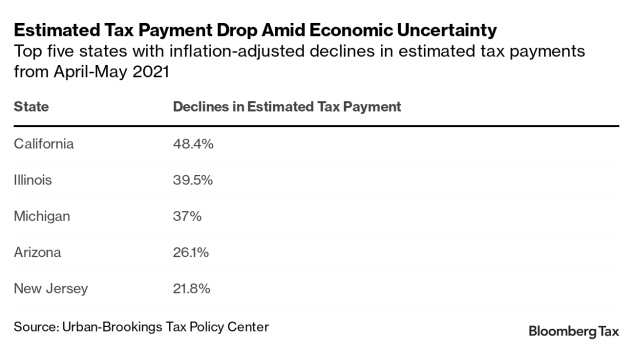

State Tax Withholding Weakens As Inflation Hits Us Wages 1

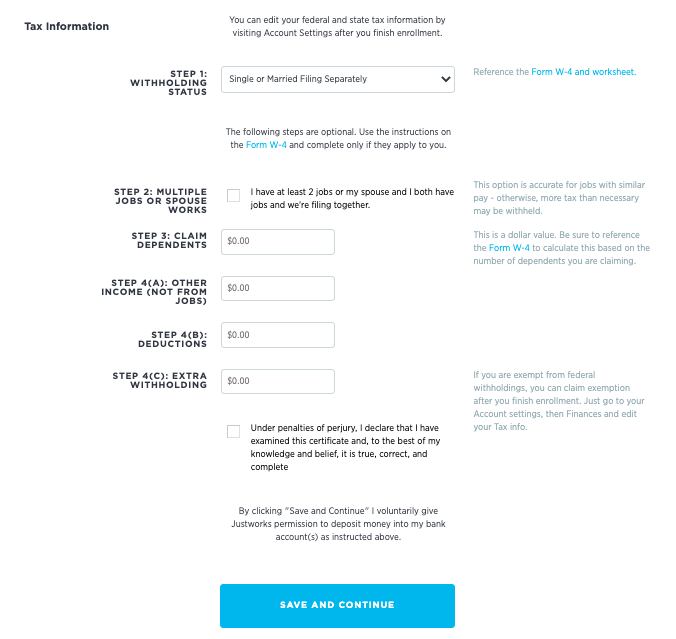

Questions About My Paycheck Justworks Help Center

Project Design Lead Salary In Chicago Il Comparably

Calculate An Employee S Final Paycheck Free Calculator Onpay